CASHCOM

IndiConnect

Our All-in-One QR App - Provides Finance and Banking Related services and empowers consumers with an easy and simple way to make payment any time anywhere.

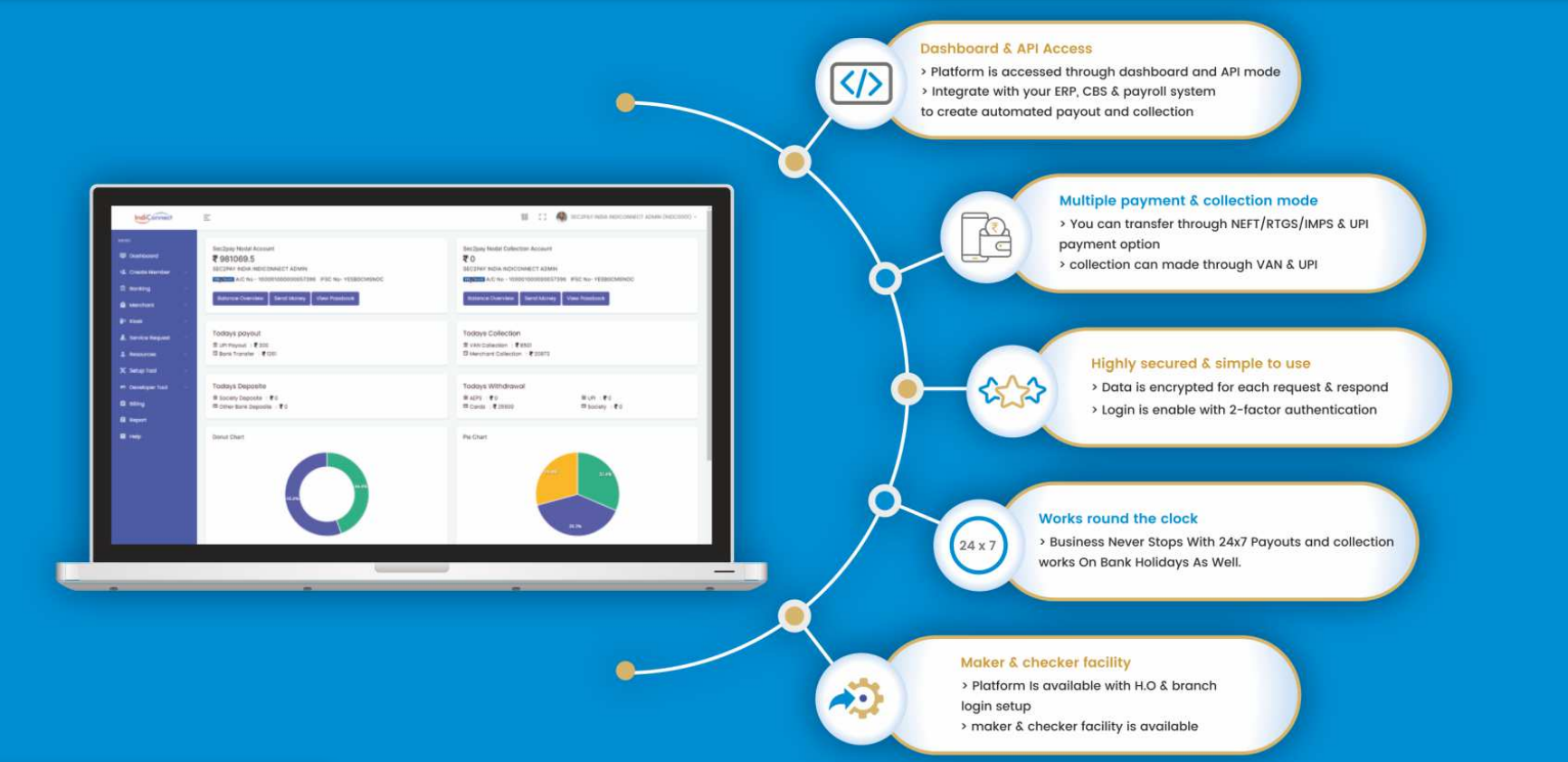

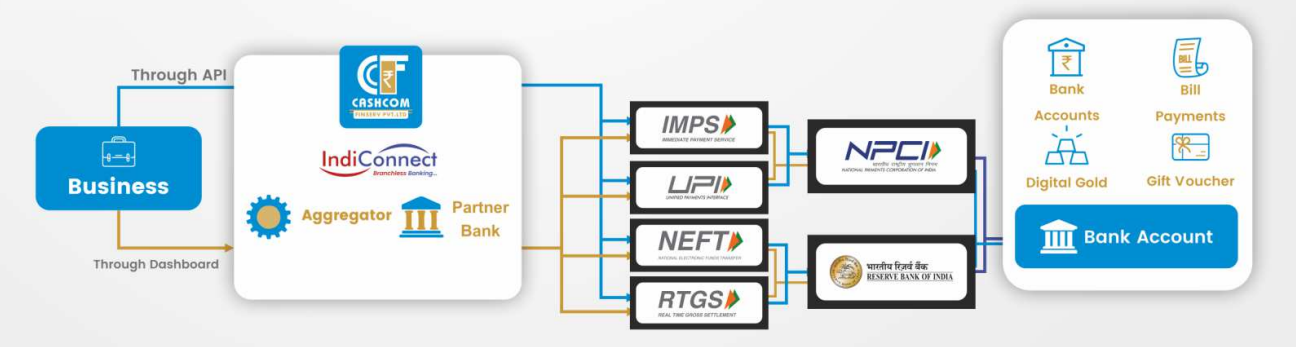

Indiconnect Payouts & Collection

Doorstep Banking

Provide Doorstep banking services to your customers with indiconnect platform

Complete Branchless banking platform for your organization

Our Marketed Financial Services and Products are the reason for millions of smiles of underserved families!

About Us

With the vision of serving banking and financial services and products across Pan India, we established our company in 2021. We provide a wide range of online payment solutions, physical cash and banking related service points in rural & urban markets of India for convenience of consumers and Societies, Patsansthas, Co-op. Sansthas, Bazzar, Nidhi companies, Individually. We are connected to tech driven organization intended to focus on financial inclusion as well as social inclusion through various banking and government organization. CashCom Finserv India, Marketed on basic philosophy of "pay in seconds" offering easy and smart ways by world class electronic transaction processing system where, a consumer can get access to do transactions within seconds by using our retail points and retailers can grow their small business.

Our Mission

To Provide Finance and Banking Related services and empower consumers with an easy and simple methods to make payments anytime, anywhere and grow their business with us.

Our Vision

We aim to provide high class technology in social and financial services and give facilities with easy access to banking & financial related products & services in India. We aim to become the most respected financial service provider that reaches out to the millions of people pan India. We aspire to live up to the expectations of our clients, our investors, and the society. Our goal is to provide employment or decent income to the unemployed youth in India as well as to provide E-Banking services to the co-operative and non-banking sectors.

Our Strategic Alliance

CashCom Finserv was established with a vision to serve Banking & finance related services and to serve the under banked micro customer segment in partnership with established bank and other service provider. To inclusion of these services CashCom Finserv is Corporate partner of Sec2Pay, to provide Banking & Finance related Services, Products to redefine Financial Inclusion Sec2Pay tie-up with below Core-Banking Partner & Corporate Partner.

Banking Partner

Corporate Partner

Integration Partner

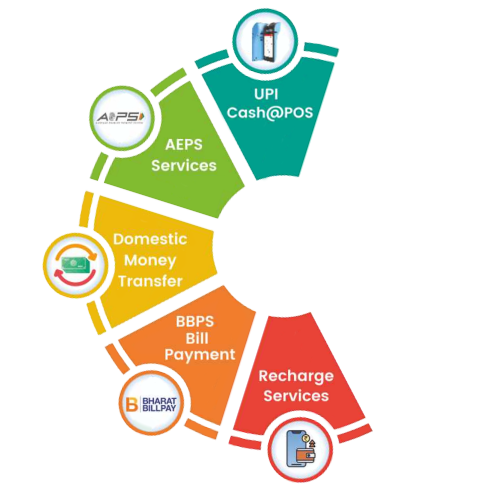

Our Services

QR Collection

Kiosk/E-lobby Banking

Payout & VAN Collection

Doorstep Banking

Insurance

Add-on

Internet

Mobile

UPI Scan

Prepaid debit card

Cash Management System

QR Collection

Get a competitive edge in your market. From now Upgrade your Business to Indiconnect All-in-One QR Code.

QR Code For All Payment Apps

Accept payments from any UPI app PhonePe, PayTM, Google Pay, BHIM and 150+ others with your IndiConnect QR code. Payments get settled in your bank account.

Instant Account Activation

Scan the all-in-one QR delivered to you with instantly activation. Your business is now ready to accept payments at no charge. yes! accepting payments with Indiconnect is absolutely free! there are no setup or transaction or any other hidden charges!

Own brand QR with pregenerated setup

Get a snapshot of your business & capital available to you with Indiconnect Balance. Know your daily QR collections, balance in interest A/c & your available loan limit all at one place.

Payout & Van Collection

Indoconnect Payouts & Collection. Smooth & Automated Payouts

Payout Flow

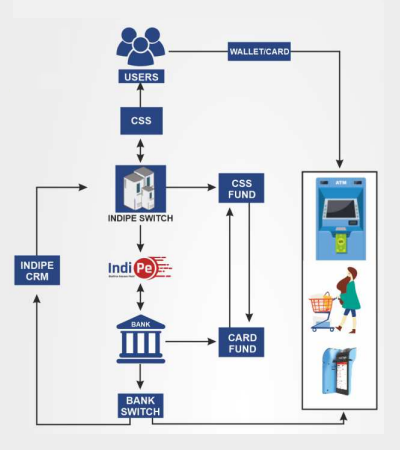

Prepaid Card

Indiconnect in association with Banks and MasterCard/Rupay offers an Open Loop Prepaid Cards. These cards are in a Sealed Kit which contains the Card, Welcome letter, PIN and FAQ.

Card Transaction Flow

Basic Card Features

Doorstep Banking

Provides Doorstep banking services to your customers with indiconnect platform

Kiosk Banking / e-Lobby

A Unique Digital & E-lobby, Kiosk Banking Solution For

All Types Of

Credit Societies & Nidhi Companies.

Launch your own Branded payment Kiosk Machine with Indiconnect to give Kiosk Banking Facility like nationalized bank to your Cutomers

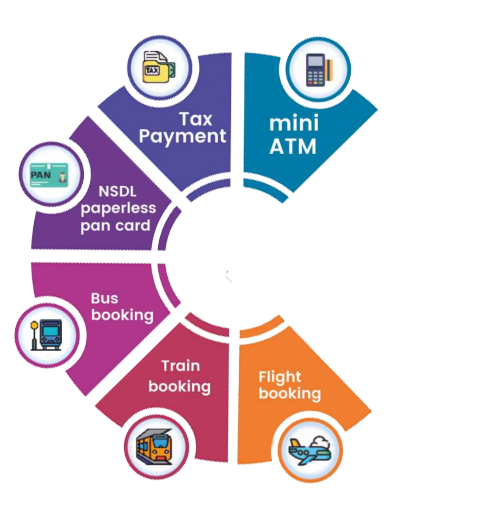

Add-on Services

Customer Verification

Credit score checking

Check Your customers credit score before providing loan & reduce NPA ratio

Insurance

Instant Policy Instant Commission

Offer insurance to your cutomers with CASHCOM & earn attractive commission

Personal Accident Insurance

Hospicash Insurance

Credit Life Insurance

Two Wheeler Insurance

Four Wheeler Insurance

Shop Insurance

Cash Management System

Collect cash at your branch location & avoid TDS on cash withdrawal from your bank A/C

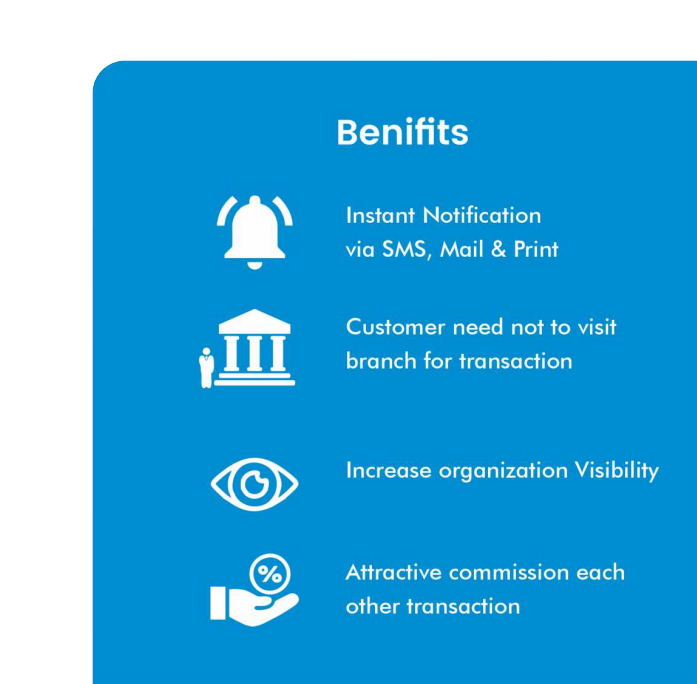

BC Services

Offer other bank services at your branch location and earn extra commission on each transaction

Here are the benifits

1. Just Verify is a subsidiary of Cashcom Finserv Pvt. Ltd., We provide one stop solution for KYC document verification.

2. We have come up with the idea of counter verification of KYC documents to irradicate any kind of fraudulent activity.

3. This one extra step can serve the purpose of being secured that too in seconds.

4. verification process helps in reducing risks of fraud and costs incurred from fraud arising from incorrect information provided.

Who can avail our services?

1. Since 2004, RBI made it compulsory for all Indian financial institutions to verify both the identity and address of all customers carrying out financial transactions with them.

2. UIDAI has also tweeted, All 12-digit numbers are not #Aadhaar. It is recommended that the Aadhaar should be verified before accepting it as identity proof.https://twitter.com/UIDAI/status/15680792465720934412s=20&t=hqHhliVWe qCx4i7g eKaflw

3. Banks, insurance firms, and other financial institutions can use digital KYC verification technologies to streamline the onboarding process, prevent fraud and money laundering. Crowd funding and virtual payment platforms are working hard to make the consumer experience as simple as possible.

We are authorized partners of eMudhra, which is the largest Certifying Authority in IndiaeMudhra supports legally valid eSignatures across 180+ countries including US ESIGN Act, elDAS Qualified Signatures, India eSign etc.Buy Digital Signature Certificate & Sign DocumentsUsed for GST, MCA, Income Tax, Tender submissions, EPFO filings, and moreeSignature platform and services allows your organization to transform paper workflows for Contracts, Agreements and Onboarding forms to paperless ones using legally valid electronic or digital signatures.

Board of Directors

Deepak Krishna Jagtap

DirectorHe has 25 yrs of extensive experience in various sectors and Director in registered Indian Companies. Currently, he serves as a director in several Companies in India. He has experience of handling HNA clients as well as associated with various industries such as Education, Manufacturing, (Food products and beverages), Construction, cooperative sector etc.

Sangram Popatrao Jadhav

DirectorHe is a commerce graduate having 15 yrs of experience specializing in Sales, Marketing, Manufacturing and Import, Export. Also, he has very creative mind to generate unique ideas out of it. He is a true representative of young Indian Entrepreneur with clear vision to reach worldwide with his business ideas.

Nikita Mahesh Chitragar

HR ManagerShe is HR Manager here at Cashcom Finserve Pvt Ltd. With having 3 years of experience in human resources management and a solid educational background, in Master's of business Administration. she is deeply passionate about creating positive workplace environments and fostering the professional growth of our team members.